Understanding your organization’s cost structure is fundamentally important. Your costs determine how you should price your goods and services. Your costs impact your profitability which determines shareholder value and your ability to invest in future growth. Your costs impact your ability to compete in your marketplace.

The largest cost for any organization is the cost of labor – your people. Many organizations are satisfied by measuring salaries and benefits, but focusing on salaries and benefits alone is misleading and this limited scope can lead to weak strategic and tactical business decisions. A more comprehensive approach is to understand the Total Cost of your Workforce (TCOW). This seems like common sense, but few companies master the concept:

- 58% of companies surveyed say they’re familiar with the total cost of managing their workforce

- 66% say their company spends the right amount managing their workforce

- However, only 27% actually understand all that goes into managing their workforce

Companies who have a limited understanding of their TCOW risk missing opportunities for stronger performance and competitive advantage.

What is TCOW?

Total Cost of Workforce (TCOW) includes the complete costs for the people who work in your organization. TCOW gives you a deeper understanding of your largest cost and it helps you evaluate options that could positively impact your business. For instance, what is the impact of reducing your turnover? What happens if your benefits costs increase or decrease – will that translate into better performance and outcomes? How should you be pricing your goods and services? Is there a better workforce model for your organization? Should your workforce model include a more robust flexible component?

Components of TCOW

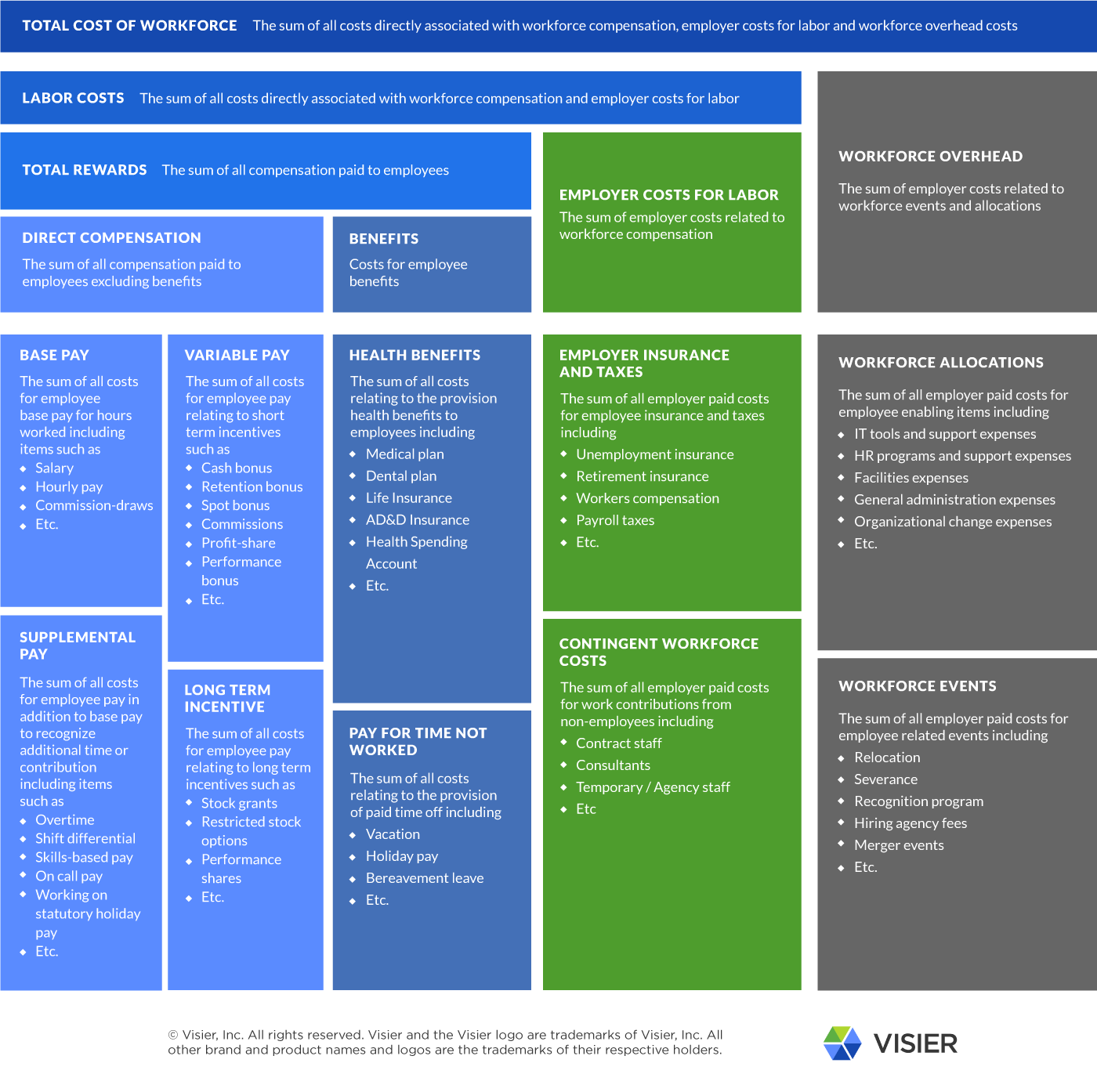

Your Total Cost of Workforce is the sum of all costs directly associated with Total Rewards, Employer Costs for Labor, and Workforce Overhead Costs. Each organization will have a different interpretation on their costs and the factors might vary by industry, but workforce costs can generally be categorized in this manner.

-

Total Rewards

Include the sum of all compensation paid to employees, including direct compensation and benefits. Direct Compensation encompasses 4 components: base pay (salaries, commissions), supplemental pay (overtime, shift differentials, etc.), variable pay (bonuses, profit sharing), and long-term incentives (stock grants, etc.).

Also included are benefits, which can include health benefits, personal benefits, and pay for time not worked. Health benefits are your medical, dental, vision plans, plus life insurance, AD&D, health spending accounts, etc. Personal benefits include items such as tuition reimbursement, retirement savings plans, and wellness perks. Pay for time not worked is vacation, holiday pay, bereavement leave, etc.

-

Employer Costs for Labor

The next major category of workforce costs includes Employer Costs for Labor, the sum of costs associated with managing a workforce. The costs include items such as employer insurance, taxes, unemployment, workers compensation, and payroll taxes.

Another significant component of Employer Costs for Labor is costs associated with a flexible workforce: temporary/agency staff, contractors, consultants, and freelancers. The use of flexible workforce models is on the rise, so it’s important to pay special attention to capture, understand, and manage this important workforce cost.

Read: The Flexible Workforce, A Guide to Creating a Fast, Nimble Team

-

Workforce Overhead

Includes costs for workforce allocations and workforce events. Workforce allocations encompass HRIS expenses, HR programs (such as training, onboarding, recruiting, outplacement), facilities, and organizational change expenses. Workforce events include relocation, severance, recognition, and hiring fees.

Click image to open in new window.

How to Measure Your TCOW

With so many components, getting accurate data on your TCOW can be complicated. Information might be spread across your organization in various systems and it might be difficult to reconcile. To capture the most accurate TCOW measurements, HR and finance need to collaborate to compile and interpret your results.

Once you have constructed a TCOW model, consider educating executives and managers on your new calculations. Management can then develop a stronger understanding of how the decisions they make might affect overall costs. Your TCOW measurements will show trends and patterns over time that can help you improve your workforce planning.

-1.png)